25+ Piggyback loan calculator

Subprime mortgages help those with lower credit. The piggyback calculator will estimate the first and second loan payment for 80-10-10 80-20 and 80-15-5 mortgages.

66dgbmyy5xwl6m

AFCC BBB A Accredited.

. Easily calculate the payment and down payment for a 80-15-5 80-10-10 or an 80-20 loan also known as a piggyback mortgage. Mortgage Piggyback Calculator 13a Two Mortgages Versus One Larger Mortgage Who This Calculator is For. Get a Free Debt Consultation.

One for 80 percent of the homes purchase price and. 25 years and 1 month would be. The charge for PMI depends on a variety of factors including the size of your down payment but it can cost between 025 to 2 of the original loan principal per year.

A fixed rate mortgage has the same interest rate and monthly payment throughout. Borrowers trying to decide whether they should take a second mortgage. In this case a first mortgage represents 75 of the homes value while a home equity loan accounts for another 15.

Mortgage Piggyback Calculator 13b Comparing Two Piggybacks Who This Calculator is For. Ad Use Our Online Refinance Calculator to Calculate Your Low Mortgage Rate. Apply for a Consultation.

To use the piggy loan approach you need to take out a 160000 mortgage loan 80. Ad Need a Business Loan. A piggyback loan also called an 801010 or combination mortgage involves getting two mortgages at the same time.

Ad Choose From Multiple Student Loan Repayment Options Loan Terms To Fit Your Budget. There are many reasons why a piggyback loan is the right choice for you. Piggy Back Mortgage Calculator Instructions.

These are the different financing options you may have available for your loan or loans. Whether Youre A Student Or The Parent College Ave Will Help You Find The Best Plan. The above calculator is for fixed-rate mortgages.

In other words the purchase price of a house should equal the total amount of the mortgage loan and the down payment. Its typically used to lower initial mortgage costs like a down payment or private. Either its good to avoid paying PMI or avoid Jumbo interest rates the piggyback loan is a loan that is a solution for.

Often a down payment for a home is expressed as a percentage of the. The two main types of piggyback loans are 801010 and 751510 configurations. A loan is a contract between a borrower and a lender in which the borrower receives an amount of money principal that they are obligated to pay back in the future.

Comparison assumes the same mortgage interest rate for both of the first mortgages. You can choose principal and interest biweekly and interest only options. 2 days agoHow to Use the USDA Mortgage Calculator.

Borrowers trying to decide between two combinations. Mortgage Piggyback Calculator 13b Comparing Two Piggybacks Who This Calculator is For. July 25 2016 - 4 min read.

Our calculator lets you pick how much you want to borrow and how long you want to borrow it for and estimates how much youd have paid back each month and overall if you. Ad Use Our Online Refinance Calculator to Calculate Your Low Mortgage Rate. Get Offers From Top 7 Online Lenders.

One loan piggybacks on top of the first loan to cover a bigger percentage. As of August 1 2022 interest rates for USDA loans range from 325 up to 6 depending on your lender credit and other qualifying. 25 28 33 and 35.

What is a subprime mortgage. After that you can apply for a piggyback loan for an additional 20000 in cash 10. In many countries 25-year mortgages are structured as adjustable or variable rate loans which reset annually after a 2 3 5 or 10 year.

A piggyback loan with a home equity rate of 50 percent might look something like this. An 80 10 10 or piggyback loan describes two loans that are opened simultaneously usually to purchase a home. Our Certified Debt Counselors Help You Achieve Financial Freedom.

An 80-10-10 or piggyback loan lets you buy a home with two loans totaling 90 of the price plus a 10 down payment to avoid PMI or a jumbo loan. Borrowers trying to decide between two combinations. A piggyback loan is actually a second loan after the first mortgage used to finance one property.

And like the 801010 split the remaining 10 is the. Simple easy piggyback mortgage loan calculator to avoid pmi. Sometimes it is better to get an 80 LTV loan-to-value first mortgage combined with a 10 second mortgage compared to a 90 loan requiring private mortgage insurance PMI.

Ad One Low Monthly Payment.

66dgbmyy5xwl6m

Sunlight Financial Holdings Inc Ipo Investment Prospectus S 1 A

Credit Knocks Creditknocks Twitter

7vbwbq1jp68lvm

66dgbmyy5xwl6m

Ipo Investment Prospectus S 1

Credit Knocks Creditknocks Twitter

Credit Knocks Creditknocks Twitter

66dgbmyy5xwl6m

7vbwbq1jp68lvm

2

66dgbmyy5xwl6m

Sunlight Financial Holdings Inc Ipo Investment Prospectus S 1 A

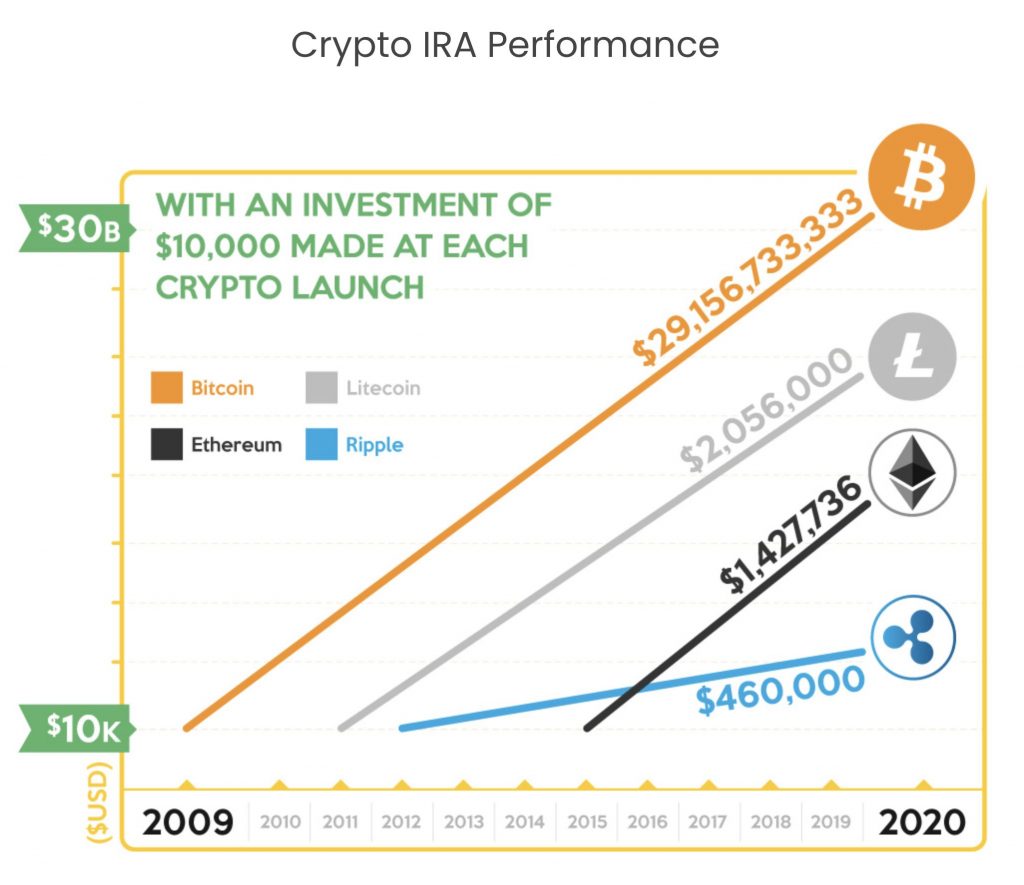

Regal Wallet Review Is This Crypto Ira Worth It

66dgbmyy5xwl6m

Pin On Credit

Ipo Investment Prospectus S 1